In Indonesia, limited liability companies can be established by foreigners through a joint venture with Indonesian citizens. Considering this requirement to enter into a joint venture with an Indonesian national, a distinction is made between the limited liability company (PM) which requires this collaboration, and the PT PMA in Indonesia. The latter is the limited liability company for foreign investment purposes (PT PMA) which can be established solely by foreign investors doing business in the country. If you want to open an LLC or another type of company in Indonesia, you should consider Indonesian law, a matter where our team specializing in company formation in Indonesia can offer complete assistance and information.

| Quick Facts | |

|---|---|

| Minimum share capital | IDR10 billion (approx. approx. USD 651,000) for the limited liability company with foreign ownership |

|

Minimum number of shareholders |

2 |

|

Number of directors |

Minimum 1 |

| Mandatory residency requirements to set up an LLC | A limited liability company with foreign ownership may be wholly or partially owned by foreign, non-resident shareholders (depending on the industry in which it activates). |

| Local director required (Yes/No) |

No |

| Time frame for setting up an LLC in Indonesia |

Approximately 1 month |

| Corporate tax rate in Indonesia |

22% |

| Dividend tax rate |

20% withholding tax on dividend payments by an Indonesian company to a non-resident, unless reduced by a treaty. |

| VAT rate in Indonesia |

11% standard rate and 0% reduced rate |

| Number of double taxation treaties (approx. ) | More than 70 |

| Annual meeting required |

It must hold an annual shareholder’s meeting. |

| Accounting and filing requirements |

The principles of the Indonesian GAAP apply. Companies file monthly tax returns and an annual tax return. |

| Foreign-ownership allowed |

Certain business sectors are closed or partially closed to foreign investors. Our team can help you with information about the applicable rules. |

| Tax exemptions or incentives for setting up an LLC in Indonesia |

A tax holiday regime applies to new businesses in certain industries. Tax allowances are available to companies with a minimum capital investment in selected industries or those operating in certain locations. A super tax deduction facility also applies to resident companies that do not benefit from other incentives (conditions apply). |

| Additional licenses | Yes, companies need to observe the necessary licenses as per the applicable Government regulations. |

The general company formation steps for setting up a PMA company in Indonesia remain unchanged in 2024, however, foreign investors need to be mindful of the special requirements that are in place for selected industries or business fields. Reaching out to our local team of experts before incorporation is advisable.

Table of Contents

Types of limited liability companies in Indonesia

The Company Law in Indonesia provides for two types of limited liability companies in Indonesia. The first type is dedicated to local investors and it is simply known as the PT. Its main features are:

- It must only have local shareholders and no foreign participation is allowed; not an option for those who are interested in immigration to Indonesia;

- The minimum share capital depends on the size of the company and starts at 50 million RP;

- Only PTs deemed as medium-sized entities can apply for work permits for foreign employees;

- The time for the incorporation of a local limited liability company is around one to two months.

The other type of limited liability company is the one with foreign direct investment which is known as the PT PMA in Indonesia and has the following characteristics:

- It requires an investment plan and a minimum share capital of USD 7000.000 for any type of business activity;

- The PT PMA in Indonesia can be fully or partially owned by foreign investors; those who wish to know more about immigration to Indonesia upon opening this company can reach out to us;

- At least 25% of the share capital must be deposited upon the registration of the PT PMA;

- There are no restrictions related to the number of business and work visas released for this type of company;

- The company registration process for this type of company takes around 10 weeks to complete.

Both the PMA in Indonesia, and its counterpart destined for foreign investment, the PT PMA, are incorporated companies that are considered legal entities and can enter into any type of commercial and business activities, as prescribed by the relevant foreign investment laws (and limitations) that can apply in Indonesia in certain fields.

Understanding the type of structures, as well as the shareholding principles is an essential step before doing business in the country and our team specializing in company incorporation in Indonesia can provide essential clarifications on many aspects related to business formation.

Our local agents can assist foreign enterprisers with the registration of a PT PMA in Indonesia.

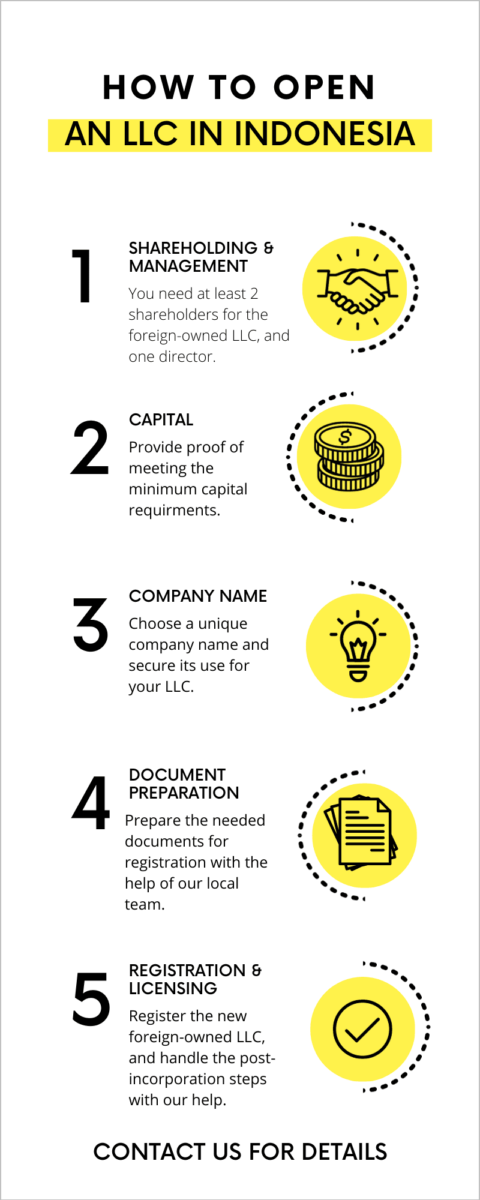

Steps in opening an LLC in Indonesia in 2024

If an LLC is established through a joint venture in Indonesia, the foreign shareholder must settle an agreement with an Indonesian partner. One should know that all the incorporation documents must be translated into the Indonesian language. These are going to be issued by the Ministry of Law and Human Rights. Please consider that the following requirements must be fulfilled when registering an LLC:

• Prepare the Articles of Association by drafting and notarizing them;

• Provide information about the owners of the company (name, address, and nationality);

• Appoint the board of directors, where at least one should be from Indonesia;

• Name a commissioner for the company, regardless of the nationality;

• Notarize the owners’ signatures and submit them to the Companies Registrar;

• Pay the registration fee and obtain the receipt which will be appended to the incorporation documents;

• Register for VAT and other tax purposes and obtain the business registration number;

• Provide all the notarized documents to the Ministry of Law and Human Rights.

Once the above-mentioned requirements are fulfilled, an LLC in Indonesia must register for employment purposes with the Ministry of Manpower and then apply for special licenses and permits, to legally start the activities.

In general, in terms of licensing, a PMA company will only need the Business Identification Number it receives after registration with the Indonesian authorities. However, for companies that are involved in activities that are considered medium-low and medium-high risk, the requirements are to also obtain a standard certification. Additionally, companies considered high-risk will need to obtain a license or permit.

We remind you that our specialists in company incorporation in Indonesia can help foreigners understand the conditions of setting up an LLC in Indonesia.

The PMA company in Indonesia involves several steps and the establishment process can last more than one month. Foreign nationals can benefit from working with our local team of experts throughout the process and the steps listed above, as well as for the post-registration steps that involve obtaining the needed licenses for the new company. These vary according to industry and our agent specializing in company formation in Indonesia can assist during this process (and during the applications/communications with the relevant Indonesian authorities).

You can also watch our video on how to open a limited liability company in Indonesia:

The responsibilities of an LLC commissioner

The appointed commissioner of an LLC in Indonesia can be non-resident, must supervise the company, needs to analyze the annual report of activities in the firm, and approve the budget plan issued by the board of managers. We mention that naming a commissioner for your LLC in Indonesia is a mandatory request.

For company creation in Indonesia, foreign investors should note that the use of nominee directors or shareholders is not permitted under law. According to the Investment Law, an agreement between a foreign investor and a local entity whereby the local party shall hold shares in the company for the foreign party is null.

The experts at our law firm in Indonesia can give you more details on the legal responsibilities.

Alternatives to the PT PMA in Indonesia for foreign investors

As seen from the description above, the limited liability company for foreign investment purposes is subject to clear rules for incorporation. However, before they decide to incorporate a fully-fledged legal entity, foreign companies have the option to open a representative office, instead of commencing the process to open a company in Indonesia.

Our team highlights the fact that the activities of the representative office (RO) are suitable for companies in certain industries, as long as they can benefit from a limited scope of activities during their first entry into the Indonesian market through such an office. Unlike the PMA company in Indonesia which is a legal entity, the RO does not have legal personality or capacity and it can be used for marketing and general liaison activities, such as conducting market research, connecting to clients and business partners in Indonesia, or other promotional activities.

While it is not a mandatory step to open an RO before commencing the process of company formation in Indonesia, our team can assist foreign companies that can benefit from first establishing a business office to test their opportunities in the Indonesian market.

We can also answer your questions if you are interested in the setup of a branch in Indonesia.

FAQ on establishing a foreign-owned LLC in Indonesia

It can take a few weeks to establish a foreign-owned LLC in Indonesia. The maximum period is around 10 weeks.

Yes, just like in the case of the local LLC, the foreign-owned company also needs at least one resident director. This does not mean that the founder cannot immigrate to Indonesia if he wishes.

If this is a suitable option, our immigration lawyers in Indonesia can give you details about the process.

Companies in Indonesia are imposed with corporate tax at a 22% rate. Certain resident companies can be subject to a reduced company income tax rate when their gross income does not exceed IDR 4.8 billion (approximately USD 301,887) in the fiscal year. In Indonesia, the standard value-added tax rate is 11%, however, some types of goods and services are zero-rated. Some goods are subject to the luxury-goods-sales-tax. Companies need to register for VAT purposes when their taxable goods/taxable services delivered exceed IDR 4.8 billion in the fiscal year.

You can reach out to our accountants in Indonesia for personalized solutions for your company.

The costs related to opening an Indonesian LLC are influenced by the necessary business license fees and on the services included in the company formation package. This is why we offer personalized services.

You can also reach out to our immigration lawyers in Indonesia if you wish to know more about the temporary residence permit.

Company incorporation statistics

Are you looking to open a company in the country in 2024? The agricultural sector is one that is evolving, as shown by a 2023 Census of Agriculture issued by BPS-Statistics Indonesia. Our team highlights some of the findings below:

- The number of agricultural corporations has increased by 35.54% compared to the 2013 Census of Agriculture; in 2023, it amounted to 5,705 units;

- Young farmers accounted for 21.93 percent of all farmers in Indonesia (approximately 6,183,009 individuals);

- Some of the top ten agricultural items being cultivated or farmed include paddy rice, native chicken, cattle, coconuts, hybrid maize, goats, palm oil, cassava, rubber;

- Food crops are the top-produced items.